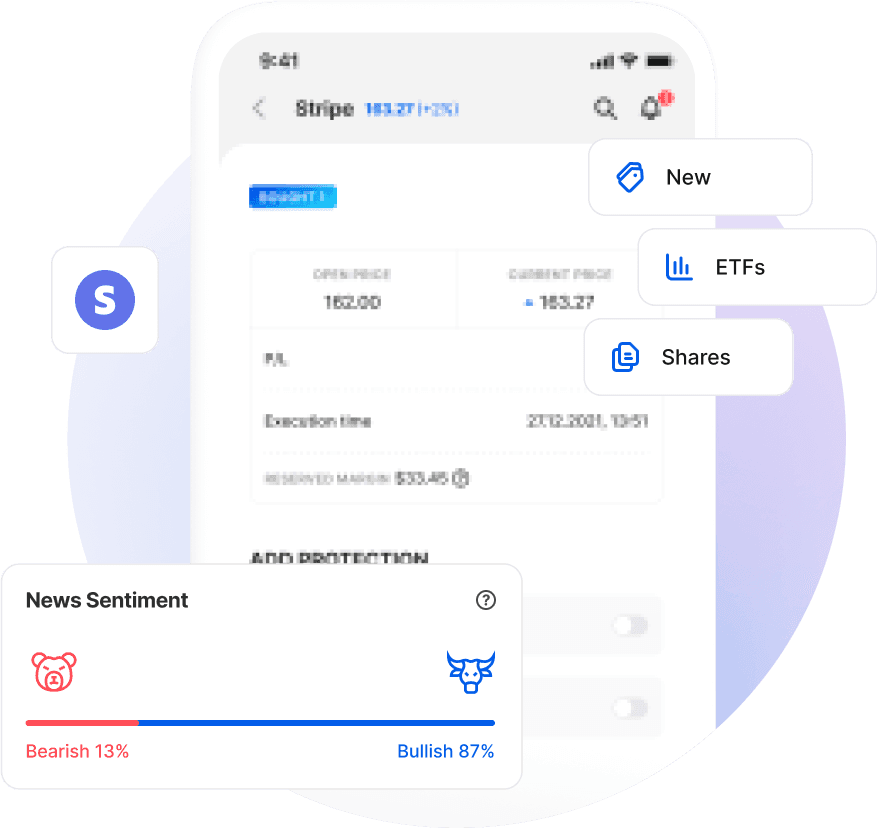

IPO stocks can offer some of the biggest trading opportunities on the market. Initial public offerings, or IPOs, attract a lot of attention and the IPO market is closely watched to find the next big stock. Fxspacemarket.com provides you with three ways to trade IPO stocks:

We are always adding new stocks to the Fxspacemarket.com trading platform, and this includes many newly listed companies following recent IPOs. Traders have been able to trade CFDs on many IPO stocks on the day of their market debut.

A company’s market cap depends on the price the company sells its shares for. Pre IPO, the company will provide a target price range for its shares, and this will often be adjusted higher or lower to reflect market demand.

In the past our clients have been able to trade CFDs on companies such as Lyft, Uber, Peloton, Saudi Aramco, and Aston Martin pre IPO with our exclusive grey Fxspacemarket.

The Renaissance Capital IPO ETF allows you to trade the performance of the freshest stocks listed in the US.

It only features stocks that went public in the last two years so it is a great way to capture the performance of the newest companies on the market.

The most significant IPO stocks are added to the ETF straight away, and the fund is updated quarterly to make sure it includes all the important stocks to go public recently.